Much of the narrative focusing on the rightsizing of inventories following the inventory glut that developed in Q1 and Q2 2022 concerned inventories held by retailers, especially general merchandisers. There was good reason for this as the seasonally adjusted inventories to sales ratio for general merchandisers rose sharply beginning in December 2021 and remained at heavily elevated levels through August 2022 before starting to decline.

As general merchandisers’ inventories to sales ratios returned to pre-COVID levels, some excitement built that this would mean a significant increase in freight volumes in the trucking sector in 2024, something that has not materialized. The seasonally adjusted for-hire trucking ton-mile index through May remains down 1% from this time in 2023. Part of the reason for the continued weakness in trucking demand is that excess inventories have not been addressed in many sectors of the economy, especially the industrial economy.

My goal in this article is to illustrate that inventory rightsizing is not an issue confined only to parts of retail trade. Rather, it has been a pervasive issue as inventories to shipments ratios in numerous manufacturing sectors such as food products, paper products, and fabricated metal products surged in 2022. As these sectors all saw less demand in 2023, efforts to right-size inventories relative to sales have had an amplified negative impact on upstream orders due to a principle called the inventory accelerator.

No sector in manufacturing illustrates these dynamics better than machinery manufacturing (NAICS 333). Machinery manufacturing in the United States is a massive sector, employing over 1.1 million people, with factories shipping roughly $452 billion in products in 2023. The chart below (permanent link here) shows inventories to shipments ratios on the left Y-axis, where as industrial production (which measures physical unit output) is on the right Y-axis. A clear inverse relationship exists; sharp increases in inventories to shipments ratios correspond to declines in industrial production (e.g., 1998 to mid-1999, mid-2008 to mid-2009, 2015 to 2016, 2019, Q2 2022 - today). Conversely, inventories to sales ratios drop when demand is strong and production is rapidly expanding (e.g., 1992-1994, 2004-2007, 2010-2014, 2017-2018). The elevated rate of inventories to shipments, coupled with declining industrial production, suggests a prolonged period of inventory drawdowns will be needed.

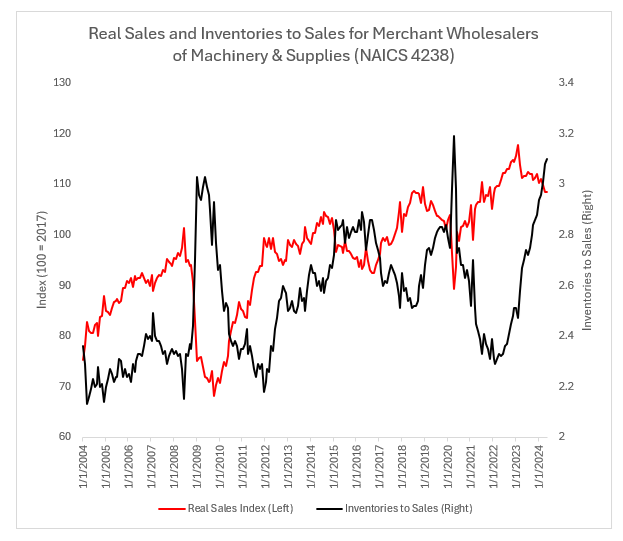

Corroborating weak demand conditions facing machinery manufacturers, wholesalers of machinery are currently reporting weaker sales and rising inventories to sales ratios. This can be seen in the next figure, which plots seasonally and inflation-adjusted sales for machinery wholesalers on the left Y-axis as an index where 100 = 2017, whereas the right Y-axis charts the ratio of inventories to sales. An identical pattern emerges. What is worth emphasizing is that data for the most recent months show weakening sales, coupled with rising inventories relative to sales. Given how bloated inventories are relative to sales, it will take at least two quarters (and realistically a year or more) for wholesalers of machinery to bring inventories in line with sales unless there is a sudden spike in machinery demand (which seems unlikely until the Federal Reserve begins reducing interest rates).

About the author:

Jason Miller is the interim chairperson and Eli Broad Professor of Supply Chain Management in the Department of Supply Chain Management of the Eli Broad College of Business at Michigan State University.

SC

MR

More Inventory Management

- Integrating inventory into air vs. ocean international transportation modal choice strategies

- Why we can’t ignore inventory rightsizing in industrial sectors

- Improve stock control and predictability to overcome inventory performance barriers

- Can Data Solve Retail’s Goldilocks Problem?

- Inventory Optimization, It’s Complicated

- More Inventory Management

What's Related in Inventory Management

Explore

Explore

Topics

Procurement & Sourcing News

- Gen AI on Gartner’s Hype Cycle fast track to mainstream adoption

- Reglobalization drives the modern supply chain network

- Mapping the impact of geographic differences on global supply chain practices

- Join the Real Housewives of Supply Chain, change leaders in exclusive sessions at NextGen Supply Chain Conference

- Global footwear innovator taps 3PL expertise to boost U.S. presence

- Use value to drive organizational change

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks