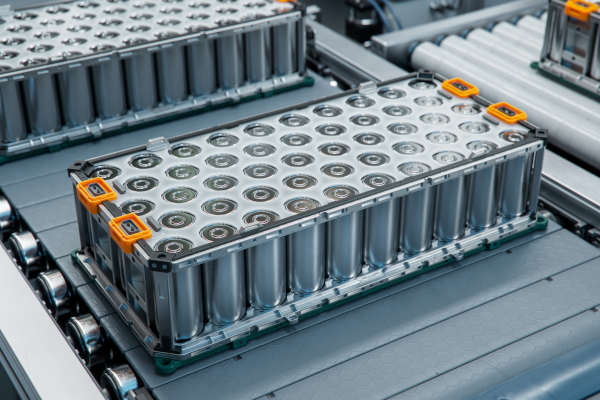

Recycling the battery packs that power electric vehicles will help boost the market for EVs, improve the industry’s environmental footprint, and grow this multi-billion dollar industry. But first, the industry must overcome two major challenges: increasing unit volumes and developing an efficient reverse supply chain for used batteries.

Materials such as cobalt, copper, lithium, and nickel reclaimed from end-of-life EV batteries can be reused again and again because the recycling process does not degrade them, said J.B. Straubel, CEO of Carson City, NV-based EV battery recycler Redwood Materials Inc. He was a panelist at the Climate Week NYC conference, in New York City, on Sept. 25, 2024. The EV battery circular supply chain could ultimately provide much of the material needed to make new units, reducing the need for virgin materials, said Straubel. That means less reliance on costly, environmentally damaging mining operations.

Redwood has a campus just outside Reno, Nevada, and is constructing a second facility in Charleston, North Carolina. In September, it announced a partnership with BMW North America to recycle lithium-ion batteries from EVs made by the BMW Group comprising over 700 locations, including dealerships, distribution centers, and internal facilities.

Straubel, who spent 15 years at Tesla before founding Redwood in 2017, said that besides removing dirtier mining operations from EV supply chains, the recycling process has become cleaner and more efficient over recent years, and will continue to improve its environmental performance.

vin the volume of used batteries flowing into its facilities, said panelist Kurt Kelty, vice president, battery cell and pack, GM. He left Tesla to take on this newly created role at the automaker in February of this year. The industry is still in its early stages, said Kelty, and is reliant on used units from relatively old models such as GM’s Volt EV and scrap material from manufacturers.

The problem is that the number of EVs in use is relatively low and new vehicles don’t have to replace their battery packs for 10 years or more. The Boston Consulting Group estimates that demand for cathode materials will more than double between 2025 and 2030, but most of the battery material that will be available for recycling until around 2035 will be production scrap. Thereafter, volumes of material from retired EV batteries will overtake production scrap as the most important source of secondary material.

Another issue the industry must overcome is the potential impact of changing battery technology on recycling rates. According to Kelty, China extensively employs lithium iron phosphate (LFP) chemistry in batteries, and its usage is likely to increase in the US. Retired LFP-based batteries are less valuable than other types, he pointed out. Straubel acknowledged that the cost profile of used LFP units may be less attractive from a recycling perspective, but emphasized that it is still possible to recover valuable materials from the batteries.

The industry also needs to address the challenge of building reverse supply chains for used batteries. Supply chains that cost-effectively move these units from the field to recyclers, especially at scale, are critically important. Safety is a key issue, said Kelty, since hazardous materials are involved. Also, supply chains need to be regional because moving the materials over long distances is expensive. Companies like GM are working with logistics services providers to develop collection services, said Kelty.

Issues such as the high cost of vehicles and limited charging infrastructure have dampened demand for EVs recently. Kelty is hopeful that the introduction of new models will stimulate demand. GM has nine models in its EV fleet and plans to increase this to 12 by the end of the year, he said.

The industry also benefits from government support. Recycled battery materials qualify for tax credits under the U.S. Inflation Reduction Act 2022. In September, recycler Ascend Elements announced it is receiving a $125 million cost-sharing grant from the U.S. Department of Energy’s Office of Manufacturing and Energy Supply Chains. The grant is part of a $3 billion federal investment in 25 selected projects across 14 states to boost domestic production of advanced batteries and battery materials nationwide.

An analysis of the EV battery recycling market from consulting firm McKinsey concluded that profitability is in sight. Revenues are expected to grow to more than $95 billion a year by 2040 globally.

About the author:

Ken Cottrill writes about sustainability and supply chains. He can be contacted at [email protected]

SC

MR

More Electric Vehicles

Explore

Explore

Topics

Procurement & Sourcing News

- Build a Supply Chain Roadmap to Grow Your Future Business

- Logistics key to supercharging EV battery recycling

- NextGen Supply Chain Conference set for October 21-23

- Port strike ends, but issues remain

- ISM reports Services economy heads up in August for third consecutive month in September

- What is the future of procurement?

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks